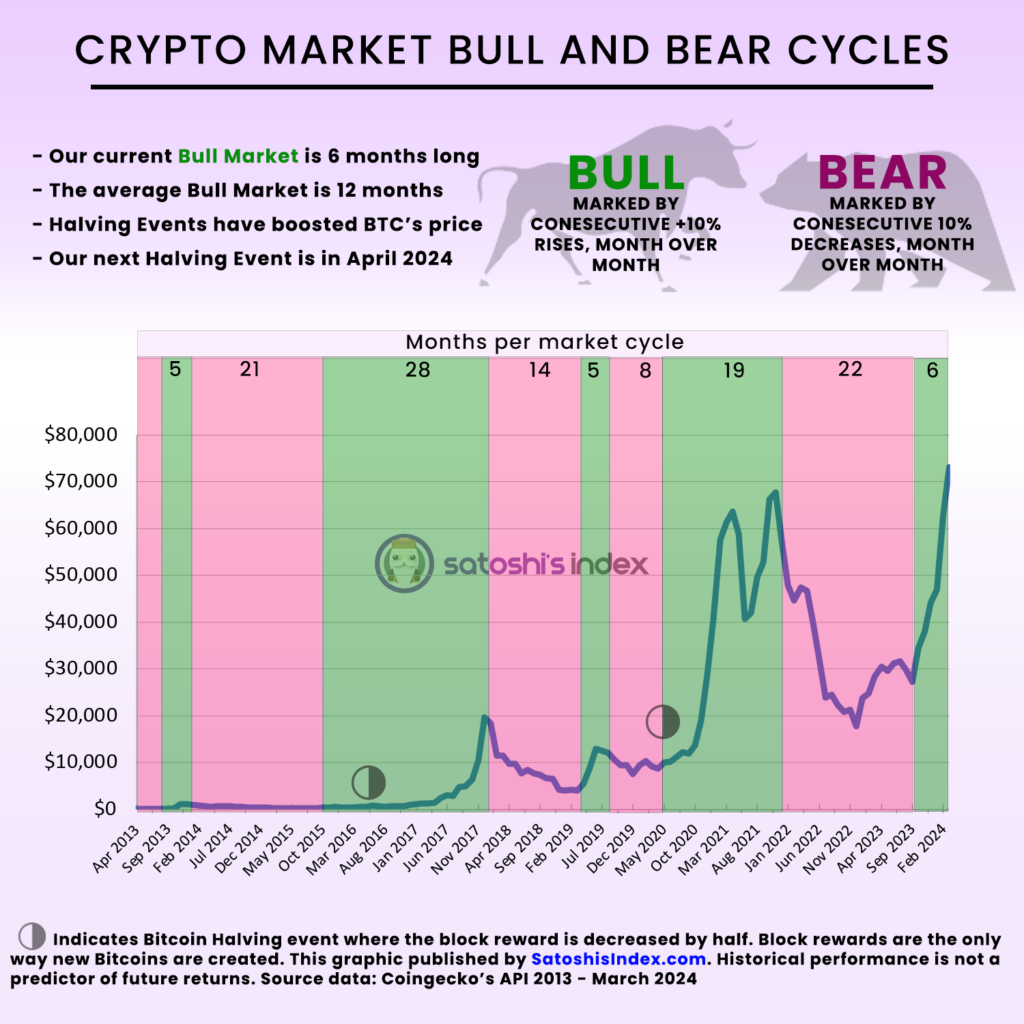

A little over half a year ago we leveraged historical data from CoinGecko to determine how long the last bear market cycle could last. At the time, the bear market was going 20 months strong and it would eventually become the longest recorded crypto bear market. For Spring of 2024, we’ve revisited the data to determine how long the current bull market may last.

How to define a crypto bear (or bull) market cycle

High level insights

- As of April 2024, the current bull cycle has lasted 6 months starting in November of 2023

- The average bull market cycle lasts 12 months

- Bitcoin halving events have historically accelerated bull markets

- The next Bitcoin halving event is estimated to happen in April 2024

- During halving events, the block rewards that miners receive for securing the network are halved

- Mining is the only way new Bitcoins are created!

- Prior to the 2024 halving event, about 900 bitcoins were mined each day worth about $63 Million (if BTC = $70K)

- Miners sell a majority of their Bitcoins to cover expenses and lock in profits

- Among other variables, when the mining reward is cut in half less sell pressure is placed on the market which can raise Bitcoin prices

- Historically, 5 months after a halving event Bitcoin’s price begins to accelerate, exhibiting consecutive double digit monthly growth

- Historically, 6 months after a halving event, the price of Bitcoin has increased by 77%

- Historically, 18 months after a halving event, the price of Bitcoin peaks.

- The popularity of US Bitcoin ETF’s may further accelerate the current bull market

Infographic: How long was each bull and bear market cycle?

Our analysis begins in 2013 using Coin Gecko’s historical data. Unfortunately there are no reliable ways to get data before this time so this serves as a strong starting point. The raw data for the above infographic can be found here.

Get our research in your inbox

No BS crypto & web3 research that won’t clog up your inbox. We tend to send less than two emails per month.

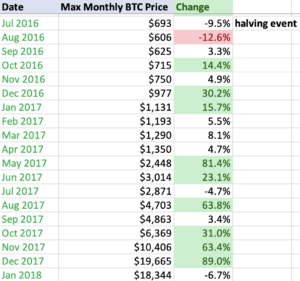

How did the July 2016 Bitcoin halving event impact the market?

Bitcoin halving events typically increase the price of Bitcoin but this impact is not always immediate. During the July 2016 halving event, Bitcoin’s price actually saw negative monthly growth, Bitcoins price fell by -9.5%. Three months later, growth quickly started to ramp up (as shown below) and continued until the end of 2017. This period of time teaches us that positive price action is not always immediate following a halving event. consecutive double digit growth did happen until 5 months after the halving event.

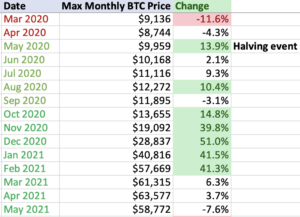

How did the May 2020 Bitcoin halving event impact the market?

In contrast to the previous halving event, May 2020 saw an immediate increase to Bitcoin’s price. However, both years shared on commonality: consecutive double digit growth took 5 months to trigger. This tells us that we may need to be patient again this year to experience more explosive growth after the halving event.

How long will this bull market last?

Can the approval of Ethereum ETF’s in the US extend this bull market cycle?

The potential approval of an Ethereum ETF by the SEC holds significant implications for potentially extending our current crypto bull market cycle. An SEC-approved Ethereum ETF would offer investors a regulated and accessible vehicle to gain exposure to the world’s second-largest cryptocurrency by market capitalization. For seasoned investors familiar with traditional markets, the introduction of such an ETF would signify a milestone in legitimizing Ethereum as a mainstream investment asset. The increased accessibility and liquidity provided by an ETF would likely attract a broader range of investors, including institutional players who have so far remained on the sidelines due to regulatory concerns. As a result, the influx of capital into the Ethereum market could fuel a sustained uptrend, extending the current bull market cycle.

Accumulating wealth in a bull market is no different than in a bear market

The Satoshi’s Index investment community is long-term focused. We don’t care about cycles and instead we value consistent dollar cost average investing over a long period of time. We’ve developed tools to help investors consistently invest in the background and for years we have touted the strength of crypto diversification. A few quick tips:

- Create an investment goal + exit plan (how much you want to make before exiting the market)

- Determine the amount of disposable income you have available every week or month to responsibly invest

- Set-up recurring buys every week or month in either Bitcoin or other top cryptocurrencies

- Allow your strategy to run in the background until the next bull market comes around

- Analyze your returns once coin valuations rise to determine if conditions are met for you to initiate your exit plan

Other considerations during a bull market

A final note. It’s crucial to heed a warning around the excitement surrounding bull cycles: beware of individuals or sources claiming to possess the knowledge to accurately predict the duration of a bull market or the best moment to cash out. While it’s tempting to seek guidance from those with a background in technical trading or influencers in the space, the reality is that no one can accurately forecast the future trajectory of the crypto markets. Attempting to time the market based on speculative advice can lead to significant losses and missed opportunities. Remember, successful investing is about disciplined strategy and informed decision-making, not chasing after elusive predictions. Build your own strategy and goals ahead of time and use investing tools like Dollar Cost Averaging to maintain discipline.