Find quick answers below

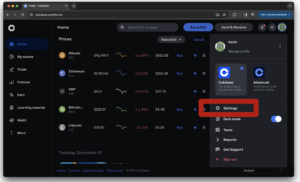

Access to automated investing tools and a portfolio management dashboard through our web app. Immediately launch an advanced trading bot + long term Dollar Cost Average (DCA) investing strategy that plugs into your exchange. You hold custody of your coins. Watch the walkthrough video.

We recommend completing these steps in Chrome on a desktop or laptop. Full video instructions here.

- Navigate to Coinbase and click on Settings / My Preferences, then click on API near the top of the screen. If you cannot see API scroll right.

- Create a new API key by clicking +New API in the top right. You may be asked to double authenticate during this process.

- Select all accounts and permissions, then deselect ‘wallet:withdrawals:create’ and ‘wallet:transactions:send’. Satoshi’s Index does not need these permissions.

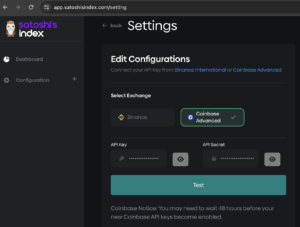

- Click Create, then copy and paste your new API key and API Secret into the Satoshi’s Index settings page. If you are unable to generate an API Secret, try using a different browser.

- Click Test to see if your API works! If you receive an error double check your API is enabled in Coinbase. New API keys can take up to 48 hours to become enabled. If your API key is new, you can still click save.

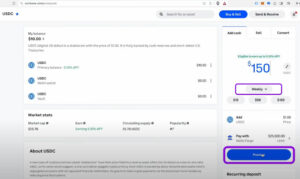

- Finally, did you remember to fund your Coinbase account? Navigate to Coinbase and search for USDC. Select recurring buy and choose weekly or monthly. Satoshi’s Index uses your account’s USDC balance to make trades. A minimum of $150 is recommended per investing cycle.

Navigate to Binance or Binance US. After loggin in click API Management from your profile icon in the top right to get started. To add an additional layer of security when generating a Binance API key, add our IP address: 35.207.152.104

Full video instructions below:

DCA is an investment strategy where you make relatively small, planned purchases of an asset at specified intervals. This makes DCA strategies great at reducing timing risk, which is the likelihood you’ll invest all your money into a coin right before its price falls. It also smooths out volatility swings by averaging your investments over time, which anyone in the crypto space will know can be quite dramatic!

Satoshi’s Index is not a custodian. We do not hold or sell any crypto currencies. Instead, Satoshi’s Index tracks the most popular crypto currencies on the largest exchanges. The algorithm uses trading volume as a key indicator to determine the top 10 most popular coins from the past month. These coins can be automatically purchased in your exchange account using our automated DCA trading bot. Trading volume is used as a key indicator because it is a forward looking indicator of future success vs. market capitalization which is a historical indicator of success. We have extensively documented this strategy on medium.

Satoshi’s Index is compatible with Binance International and Coinbase Advanced.

Looking up the top coins every month and executing trades requires time. If you have the time and the dedication, you can certainly do it yourself. Many exchanges offer a recurring buy feature that allows you to purchase coins every month, but this is not entirely set it and forget it because the most popular coins will change on a monthly basis. Knowing when to sell is another challenge that Satoshi’s Index automates.